According to the Ministry for the Environment (MfE), the government will be testing its role in the nature credit market through a series of pilot projects, which will be privately funded. The projects involved in the trial hope to generate income opportunities for landowners, community groups, iwi, Māori and farmers who look after nature on their land. The credits will be registered in the market and sold to investors or businesses interested in the projects and activities.

All businesses depend on nature — and right now, nature is in crisis. Climate change is compounding that crisis, so regenerating our natural systems is no longer optional. At SBN, we’ve been connecting community-led programmes with businesses for decades to help close the nature finance gap of around NZD$22.5 billion annually.

It’s great to see MfE testing and piloting new ways to finance nature regeneration. If you're keen to understand what nature finance is all about, come along to the Nature & Business Symposium on 6 August. Early bird tickets close 18 July. We will be hosting a panel that explores the different financial mechanisms that enable organisations to invest in nature while also delivering social and economic benefits. The panellists will discuss the key drivers behind their investments and the role of cross-sector collaboration.

SBN Founder Rachel Brown says it’s encouraging to see growing momentum in the nature financing space.

Businesses need new tools and incentives to value and restore nature — finance can be a powerful driver of action. We welcome the leadership emerging from government and projects across the motu. It’s also reassuring to see experienced voices like Sean Weaver and Louise Saunders involved — people with deep expertise and integrity, who’ve earned the trust of both business and community.

"There are now many ways for businesses to connect with and support nature — from partnering with community groups and iwi/hapū on local projects, to investing in regeneration through mechanisms like nature credits. We need all of these approaches working together to create meaningful, lasting impact.”

The motivations of credit buyers will most likely vary case by case but the trials will be useful in understanding the market demand both nationally and internationally. In a recent LinkedIn post Sean Weaver, Founder of Ekos wrote, “Ekos biodiversity credits are not offsets of any kind. The Ekos BioCredita programme does not commodify nature or put a price on nature. It puts a price on the human labour and technology cost to look after nature - just like philanthropy does. It is simply a new approach to funding biodiversity conservation.”

The announcement from MfE came after a public consultation in 2023, which indicated strong support for such a system. However, concerns have been raised by some, including Manaaki Whenua – Landcare Research regarding the challenges of designing and delivering a biodiversity credit market with integrity. Whilst it’s an important tool towards Aotearoa New Zealand’s nature positive goals these challenges will need to be explored and investigated during the trial.

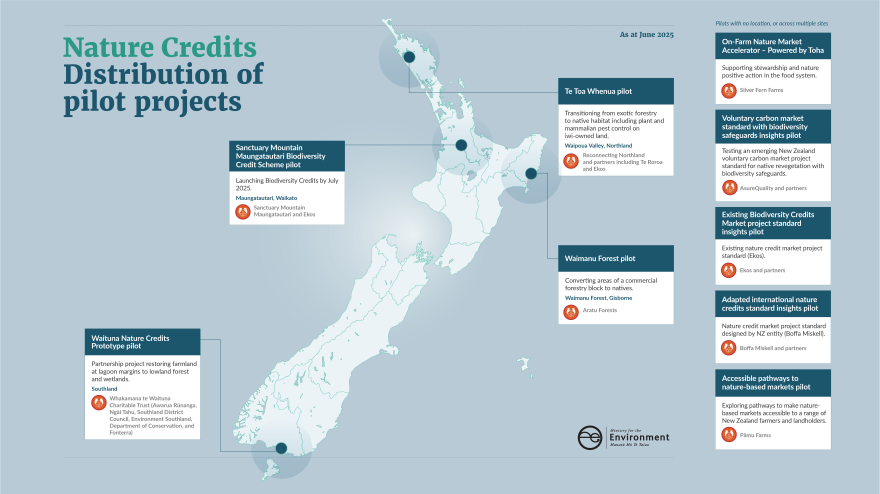

Pilot projects

These are the nine pilot projects involved in the MfE trial. The projects represent different land conditions, locations, types of market and participant activities.

Te Toa Whenua - Northland

Led by Reconnecting Northland. Transitioning around 100 hectares from exotic forestry to native habitat including plant and mammalian pest control on iwi-owned land.

Waituna Nature Credits Prototype - Southland

Led by Whakamana te Waituna Charitable Trust (Awarua Rūnunga, Ngai Tahu, Fonterra, Southland District Council, Environment Southland, and Department of Conservation). Restoring 400 hectares of farmland at lagoon margins to lowland forest and wetlands (RAMSAR protected site).

Waimanu Forest - Gisborne

Led by Aratu Forests. Converting areas of a commercial forestry block to 50 hectares of natives for biodiversity uplift and increased recreational and educational values. Scope to expand to up to 5,000 hectares.

Sanctuary Mountain - Maungatautari

Biodiversity Credits Scheme, Waikato, led by Sanctuary Mountain Maungatautari. Observing the current process of issuing credits for conservation and protection activities within the 3,363 hectare inland ecological sanctuary.

Existing Biodiversity Credits Market (BCM) project standard insights

Led by Ekos. Offering market insights from an existing BCM provider. Includes understanding the journey of Reconnecting Northland’s proof-of-concept project through this process.

Adapted international nature credits standards

Led by Boffa Miskell. Testing at-place an additional NZ Biodiversity Credits Market project standard that is adapting UK methodology to NZ environments as a competitor to domestic or international project standard/certification providers.

Voluntary carbon market standard with biodiversity safeguards insights

Led by AsureQuality. Testing its carbon project standard, which requires native revegetation and includes biodiversity safeguards. Designed to be more applicable and affordable for the New Zealand context.

On-farm Nature market accelerator – powered by Toha

Led by Silver Fern Farms to support stewardship and nature-positive action in the food system. Pilot involves testing a processor-led programme for market attraction, and potentially third-party investment, in on-farm nature restoration and enhancement activities that support commercial ‘nature positive’ claims.

Accessible pathways to nature-based markets

Led by Pāmu Farms. Exploring pathways to make nature-based markets accessible to a range of New Zealand farmers and landholders.

Resources

We’ve pulled together a range of resources to help you understand what this all means.

We will be exploring nature credits in more depth at the Nature & Business Symposium on 6 August. Gain insights from the panel discussion ‘Working together to close the nature finance gap’, hosted by Dr Kayla Kingdon-Bebb, CEO, WWF NZ.

Read

-

Ministry for the Environment report: Scaling up voluntary nature credits market activity in New Zealand - proposed government rules

-

Landcare Research policy brief: Design and delivery of voluntary biodiversity credit markets: eight difficult problems

-

EnviroStrat insights: A new tool for nature: NZ government to launch voluntary nature credits markets principles

-

WWF media release: Government’s support of voluntary nature credits a ‘welcome step’

-

Forest & Bird media release: New voluntary nature credits market must have integrity

-

EY insights: How can New Zealand turn biodiversity into a financial asset and climate solution